Ira Limits 2025 Images References :

BlogIra Limits 2025 Images References : - Ira Contribution Deduction Limits 2025 Bunnie Leeann, The contribution limits for a traditional or roth ira increased last year but remain steady for 2025. For 2025, the total contribution limit to roth iras remains $7,000, unchanged from 2025, according to the irs’ announcement friday. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 and 2025 tax years is $7,000 or $8,000 if you are age 50 or.

Ira Contribution Deduction Limits 2025 Bunnie Leeann, The contribution limits for a traditional or roth ira increased last year but remain steady for 2025.

Roth Ira Limits 2025 Mfj Claire Paige, In 2025, the contribution limit increases by $500 to $16,500.

Roth Ira Limits 2025 Tax Sue Burgess, 2025 roth ira contribution limits.

Ira Contribution Limits 2025 Kelli Reggie, Additionally, roth iras offer the benefit.

401k Roth Ira Contribution Limits 2025 Mary Anderson, In 2025, the contribution limit increases by $500 to $16,500.

401k Limit 2025 Elka Martguerita, Determine if you are eligible for certain ira benefits using your agi and modified agi.

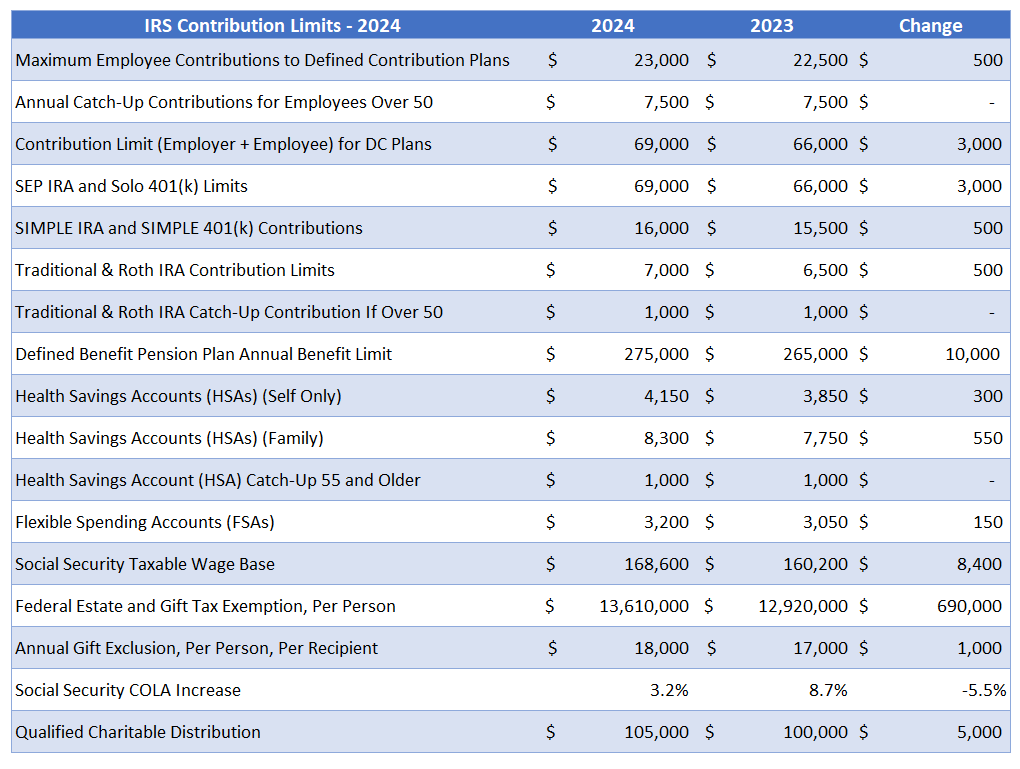

Ira Limits 2025. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2025 and 2025 tax years is $7,000 or $8,000 if you are age 50 or. The internal revenue service (irs) recently issued the retirement plan limits for the 2025 year, detailed in the chart linked to below.

Ira Limits 2025 For Simple Tax Verna Horvath, For 2025, employees can now contribute up to $23,500 to a 401 (k) or 403 (b) plan if they’re under 50, up from $23,000 in 2025.

2025 Roth Ira Contribution Limits Married 2025 Kimberly Underwood, Most limits related to retirement plans will be slightly.

Simple Ira Limit 2025 Binni Cherlyn, Learn about tax deductions, iras and work retirement plans, spousal iras and more.

Simple Ira Limits 2025 Cameron Ogden, For 2025, the roth ira contribution limit holds steady at the same level as 2025.